HEIDRICK & STRUGGLES

Letter to Stockholders

April 14, 202312, 2024

Dear Fellow Stockholders,

2022As I begin my tenure as CEO, I am proud to be joining such an accomplished team at this exciting time in the company’s history. As a former Heidrick & Struggles client, I have a deep appreciation for the exceptional value we offer and the enormous opportunities that lie ahead.

2023 was another excellentan outstanding year for Heidrick & Struggles. We successfully delivered forhelped our clients discover and managedenable the visionary and transformative leadership they urgently needed during a time of almost unprecedented global and economic change. Our strong financial results reflect our business through heightened geo-political threats, global economic uncertaintysuccess in doing that.

Even with our solid performance, I believe the opportunity in front of us is vast. The challenges facing companies today – an AI-driven revolution in work, deepening divisions at work and in societies, and a complex geopolitical landscape, to name just a few – demand that organizations have the turn out ofright leadership, armed with the pandemic. Againstright tools, to thrive and grow. We are building a company that meets this challenging backdrop, we continued to lead from the front guided byurgent need.

Three principles drive our purpose – to help our clients change the world, one leadership team at a time.

We surpassed $1 billion in annual net revenue for a second consecutive year, and we maintained our focus on delivering strong growth and profitability, while investing strategically in developing new digital assets and enhancing our existing offerings and capabilities. We also further solidified our position as a leader in providing compelling, differentiated solutions to our clients, and we advanced our diversification strategy and objective of achieving a more balanced revenue profile between our search and non-search businesses. Critically, we made significant progress on our firm’s broader transformation. We have been doing this by focusing on two primary areas – Talent Acquisition and Effectiveness of Leaders, Teams and Organizations.

Under Talent Acquisition, we have our Executive Search and On-Demand Talent businesses.strategy:

| 1) |

|

| 2) |

|

Under Effectiveness of Leaders, Teams and Organizations, we have Heidrick Consulting and our Digital Assets.

|

| 3) |

|

In additionOur purpose is to focusing on our financial, operationalpartner with clients to create unrivaled economic value for their organizations and strategic business objectives, we continuedcommunities. The evidence is very clear that great leaders, empowered with solutions to advance on our ESG (Environmental, Sociallift the performance of their teams and Governance) journey and published our second ESG report. Our ESG clientthemselves, are the most important way to make that happen. We are hard at work grew and expandedcreating more value for more clients in scope,more ways – and we maintained our focus on incorporating best practices around sustainability, governance, leadership, culture, diversity, equity and inclusion across our firm.

We are continuing to transform and build for the future with an expanded range of premium, data-driven talent and human capital solutions. In today’s fast-changing world, our aim is to provide a new generation of business services solutions and digital products that enable companies to achieve higher performance through their leaders and teams. Looking ahead, while 2023 will be challenging, we know that leadership, retention, culture and other talent and human capital related themes are critical priorities – now more than ever – with CEOs and executives as they focus on navigating the tight talent market and what the future of leadership, jobs and work will look like for their organizations.

|

PROXY STATEMENT 2023

As I consider all that we have achieved during this past year and all that we are working towards moving forward, I want to acknowledge and thank our amazing team of people we have around the world. The success of our firm is only possible through our colleagues’ engagement and commitment to advancing our growth strategy, serving our clients and supporting our teams, each and every day.deeply rewarding work.

This year we will once again conduct our Annual Meeting in a virtual format. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. in-person.

You can attend the 2023our Annual Meeting by visiting www.virtualshareholdermeeting.com/HSII2023HSII2024 where you will be able to listen to the meeting live, submit questions and vote. Information about the business to be conducted, at the 2023 Annual Meeting, attending the meeting and voting your shares may be found in the Notice of 20232024 Annual Meeting of Stockholders and Proxy Statement.

Your vote is very important to us. Whether or not you plan to attend the 2023 Annual Meeting online, we encourage you to vote promptly. You can vote via the internet, by telephone, by mail or by attending and voting online during the Annual Meeting. We hope that you vote your shares, which in turn helps us ensure our corporate governance practices, decisions and strategy all remain aligned with the priorities of our stockholders and other stakeholders. Regular, transparent interaction with our stockholders is a cornerstone of our corporate governance practices.

On behalf of our Board of Directors and our entire management team, thank you to our clients, stakeholders and stockholders for your continued confidence and investment in our firm. We look forward to progressing our goalsfirm and driving our firm’s broader transformation and diversification strategyyour warm welcome as we continue to focus on delivering maximum, long-term value to all of our stakeholders.I begin my tenure as CEO.

| Sincerely, |   | |

| ||

| ||

| 1 | ||

Adjusted EBITDA and Adjusted Diluted Earnings Per Share are Non-GAAP financial measures. A reconciliation of these Non-GAAP financial measures to the most directly comparable GAAP financial measures can be found on Annexes A and B. |

HEIDRICK & STRUGGLES

Notice of 20232024 Annual

Meeting of Stockholders

of Heidrick & Struggles International, Inc.

Date and Time

May 25, 202323, 2024

8:00 a.m., Central Time

Online check-in will be available beginning at 7:45 a.m. Central Time. Please allow ample time for the online check-in process.

Place

The Annual Meeting will be held entirely online at: www.virtualshareholdermeeting.com/HSII2023HSII2024.

If you plan to participate in the virtual meeting, please see “Questions and Answers About the Proxy Materials and the Annual Meeting.” Stockholders will be able to attend, vote and submit questions (both before, and for a portion of, the meeting) from any location via the internet.

Record Date

The Record Date for the determination of the stockholders entitled to vote at our Annual Meeting, and any adjournments or postponements thereof, was the close of business on March 30, 2023.28, 2024.

Distribution of Materials

This Notice, the proxy statement, the accompanying proxy card and our Form 10-K for the year ended December 31, 20222023 are being distributed to stockholders beginning on or about April 19, 2023.12, 2024. These documents are also available on our website at

https://investors.heidrick.com/financial-

information/financial -information/proxy-materials.

Items of Business

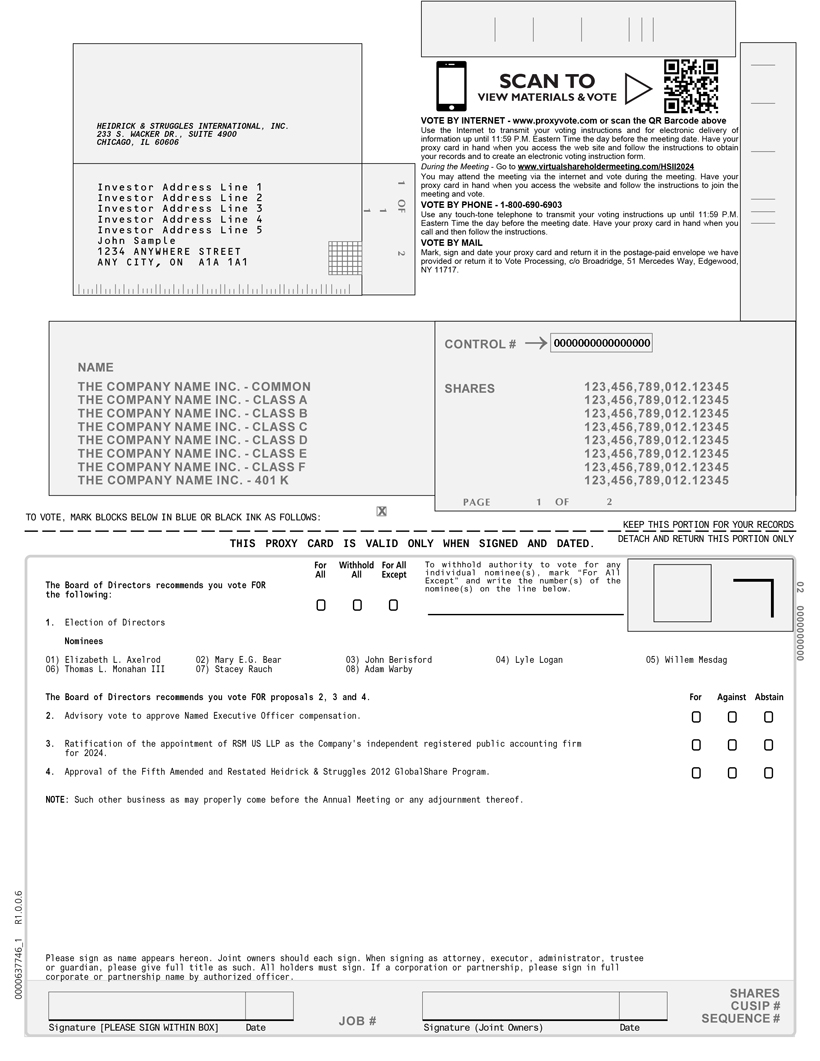

Stockholders are being asked to vote on the fivefour agenda items described below and to consider any other business properly brought before the 20232024 Annual Meeting and any adjournment or postponement of the meeting:

| 1. | Election to our Board of Directors of the |

| 2. | An advisory vote to approve named executive officer compensation (say-on-pay). |

| 3. |

|

Ratification of the appointment of RSM US LLP as our independent registered public accounting firm for the |

Approval of the |

To participate in the 20232024 Annual Meeting, you will need the 16-digit control number included on your proxy card or on any additional voting instructions accompanying these proxy materials.

On behalf of the Board of Directors,

Tracey Heaton

Chief Legal Officer & Corporate Secretary

PROXY STATEMENT 20232024

Table of Contents

Proxy statement

| Proxy Statement Summary | |||||||

|

|

|

| |||||

|

|

|

| |||||

|

|

|

| |||||

|

|

|

| |||||

|

|

|

| |||||

|

|

|

| |||||

|

|

|

| |||||

| Executive compensation | Proposal 2: Advisory Vote to Approve | |||||||

|

|

|

| |||||

| Compensation Tables And Narrative Disclosures | ||||||||

| Audit & Finance Committee Report | ||||||||

|

|

|

| |||||

Proposal

| ||||||||

| GlobalShare program |

| |||||||

| Additional matters | ||||||||

Q&A About the Proxy Materials and the Annual Meeting

|

|

|

| |||||

| ||||||||

HEIDRICK & STRUGGLES

Proxy

Statement

PROXY STATEMENT 20232024

We are providing the enclosed proxy materials to you in connection with the solicitation by the board of directors (the “Board”) of Heidrick & Struggles International, Inc. (“Heidrick & Struggles,” “Heidrick,” the “firm” or the “Company”) of proxies to be voted at the Annual Meeting of Stockholders to be held on May 25, 202323, 2024 (the “Annual Meeting”), or any adjournment or postponement thereof. The Annual Meeting will be held entirely online at www.virtualshareholdermeeting. com/HSII2023www.virtualshareholdermeeting.com/HSII2024. We began distributing these proxy materials to our stockholders on or about April 19, 2023.12, 2024.

This proxy statement contains forward-looking statements within the meaning of the federal securities laws, including statements relating to our environmental stewardship, social responsibility and governance (“ESG”) related goals and expectations. The forward-looking statements are based on current expectations, estimates, forecasts, and projections about the industry in which we operate and management’s beliefs and assumptions. Forward-looking statements may be identified by the use of words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “outlook,” “projects,” “forecasts,” “aims,” and similar expressions. Forward-looking statements are not guarantees of future performance, rely on a number of assumptions, and involve certain known and unknown risks and uncertainties that are difficult to predict, many of which are beyond our control. For more information on these risks, uncertainties and other factors, refer to our Annual Report on Form 10-K for the year ended December 31, 2022,2023, under the heading “Risk Factors” in Item 1A, as updated in Part II of our subsequent Quarterly Reports on Form 10-Q, and other filings with the Securities and Exchange Commission. The forward-looking statements contained in this proxy statement speak only as of the date of this proxy statement. We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. For more complete information regarding the Company’s 20222023 performance, please review the Company’s Form 10-K for the year ended December 31, 2022.2023.

Information set forth on our website, including our ESG Report (as defined below), shall not be deemed to be incorporated herein.

| PROXY SUMMARY |

HEIDRICK & STRUGGLES

Proxy Statement Summary

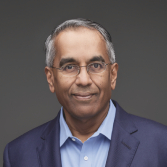

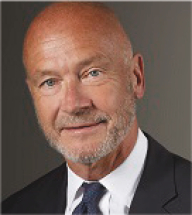

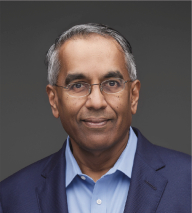

2022CEO Succession

On January 23, 2024, we announced that President and CEO Krishnan Rajagopalan planned to retire after more than 23 years with the Company. Mr. Rajagopalan stepped down as President and CEO and from the Board, effective March 4, 2024, and retired as an employee the Company on April 1, 2024, after which he has continued to serve as an advisor, working closely with clients around the world. Following a planned succession process, the Board appointed Thomas L. Monahan III to succeed Mr. Rajagopalan as CEO and a member of the Board, effective March 4, 2024. The Company also appointed Tom Murray, the Company’s Global Managing Partner of Executive Search, Regions, as the Company’s President, reporting to Mr. Monahan, effective March 4, 2024.

A discussion of the terms of Mr. Rajagopalan’s retirement is included in the Compensation Discussion and Analysis (“CD&A”) under the section “CEO Succession Process,” beginning on page 48. Messrs. Monahan and Murray’s employment agreements and compensation packages are discussed in the CD&A under the section “Offer Letter Agreements in Connection with CEO Succession”, beginning on page 68. The hiring of Mr. Monahan as CEO, as well as the promotion of Mr. Murray to President, represent the culmination of our Board’s active engagement in a planned, long-term, multi-year succession process.

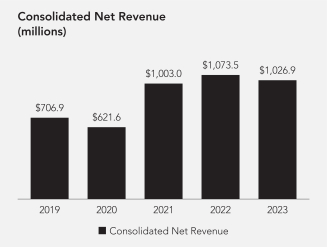

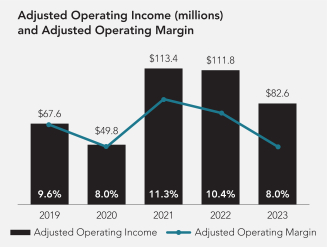

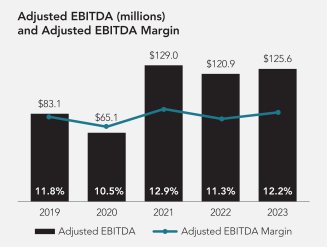

2023 Business Highlights

We are pleased with the financial, operational, and strategic progress achieved during fiscal 2022.2023. The year was highlighted by our dedicated efforts to further solidify Heidrick as a leader in providing diversified solutions to our clients while advancing our strategy, with a goal to achieve a more balanced revenue profile between our search and non-search businesses.businesses, while maintaining adjusted EBITDA margin discipline. During the year, we expanded our core Executive Search business and its geographic presence;continued to deliver strong profitability; our On-Demand Talent business continued to grow; our Heidrick Consulting business improved operations and efficiencies; and we began beta testing asigned up our first SaaS customers for our new digital product, Heidrick Navigator, which is receivingcontinued to receive positive feedback from initial client usage. Additionally, we expect our acquisition of Atreus Group GmbH (completed in February 2023), a leading provider of executive interim management in Germany, will meaningfully add to our On-Demand Talent segment.

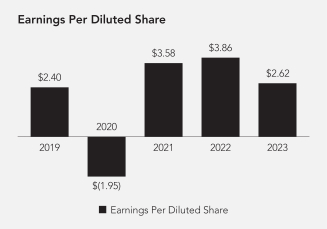

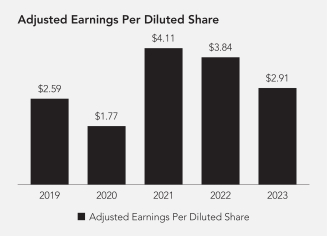

Heidrick ended 20222023 with:

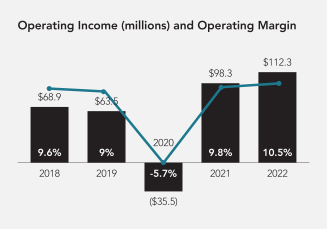

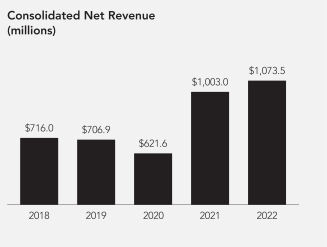

| ● | Consolidated net revenue of |

| ● | Record net revenue achieved in |

| ● | Strong balance sheet with |

| ● |

|

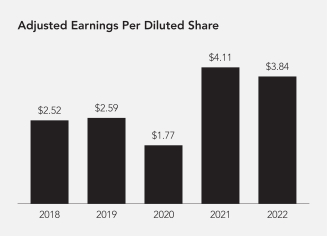

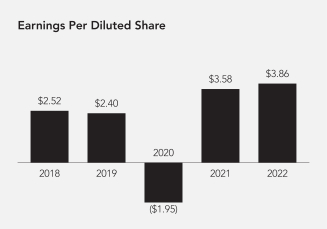

Adjusted EBITDA was |

Our strong top- and bottom-line results are a testament to our ongoing efforts to further diversify our business, as we continue to make investments for the long-term in digital product innovation and aim to set the stage for prolonged, profitable growth.

2022 Environmental Stewardship, Social Responsibility and Governance

(“ESG”) Highlights

Even as we achieved some of our best financial results in our history, in 2022 we also made important strides in ESG. We published our second ESG report, which provides an in-depth look into our ESG initiatives, outlines our expanded commitment to reduce our carbon footprint and continue substantially offsetting our carbon impact, and highlights our ongoing efforts internally and with our clients globally to build more effective and representative organizations. We are proud to share the progress we have been making on our ESG initiatives through the work and investments we have undertaken to lessen our impact on the environment, advance diversity and inclusion and innovate across our business to drive an increasingly sustainable business model for the future. At Heidrick & Struggles, we hold ourselves to the highest standards, and as a premier provider of leadership advisory services, people are at the center of all we do. Using our culture as a differentiator to attract, develop and retain the highest-performing talent and build a more diverse and inclusive firm is a strategic priority.

As trusted advisors in boardrooms around the globe, one of the most consequential conversations taking place and that we have the privilege of helping to shape is around sustainability and ESG issues.

|

| PROXY SUMMARY |

PROXY STATEMENT 20232024

Some highlights2023 Environmental, Social and Corporate Governance Highlights

Heidrick accomplished many of its ESG objectives in 2023. We published our third ESG report which covered activities that took place during the fiscal year 2022. The ESG report outlines how we address our environmental and social impact, our governance structures and how we integrate ESG considerations across our business lines. Highlights from our 2022 ESG efforts include:2023 included:

| ● |

|

| ● | We |

| ● |

|

| ● | We are proud to share our progress advancing diversity, |

People highlights from 2023 include3:

| ● | 38% of our own Board members |

| ● | Women represented 63% of our overall |

| ● | People of color represented |

| ● | In 2023, our Learning & Development team delivered over 10,500 hours of facilitated training to our colleagues globally, and employees completed over 5,000 self-paced courses. |

As we continue to make strides internally to advance our efforts in ESG matters, we also provide talent and human capital solutions that support our clients on their ESG journeys. Key 2023 updates include6:

| ● | At the Board of Directors level, 61% of our U.S. placements and 58% of our global placements7 were diverse, an outcome of our Board Diversity Pledge, a global commitment that a minimum of half of the initial board candidates presented by us to our clients globally on an annual basis will be diverse. |

| ● | Across practices, 42% of our total U.S. placements were diverse. |

| ● | We |

|

|

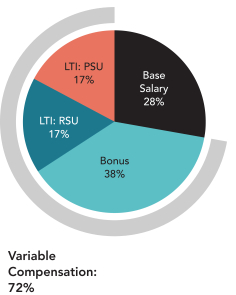

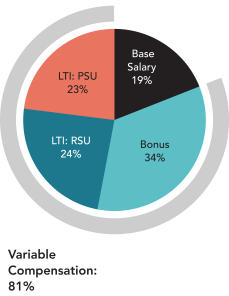

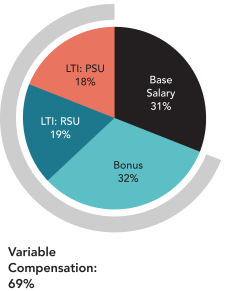

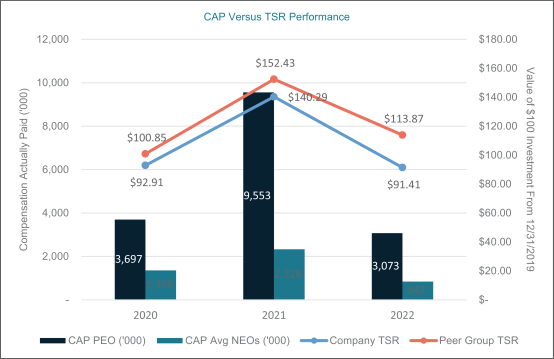

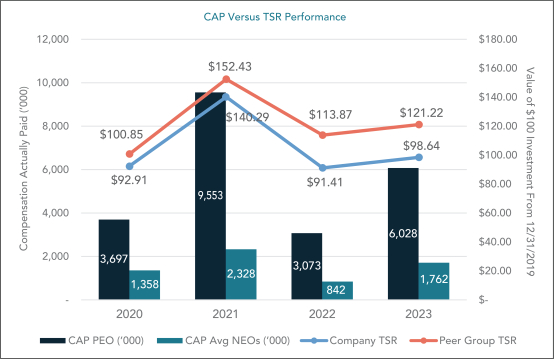

20222023 Compensation Highlights

| ● | Heidrick’s compensation program is guided by a pay-for-performance philosophy. A significant portion of executive compensation is based on variable pay, which aligns pay with performance. |

| ● | Our program is designed to drive long-term stockholder value by aligning our business strategies and operating priorities with stockholders’ interest and rewarding executives for top- and bottom-line growth. |

| ● | Our compensation philosophy focuses on attracting, retaining and motivating leaders that have the right skills to support the Company’s culture and drive short-term and long-term success. |

|

| 3 | As of December 31, 2023. |

| 4 | Excludes temporary employees deployed to clients in our |

| 5 | Excludes temporary employees deployed to clients in our On-Demand Talent business. |

| 6 | As of December 31, 2023. |

| 7 | Global updates comprise females globally plus ethnic diversity for males in the United States, Canada, Australia and the United Kingdom (“UK”) (the countries where we currently track ethnicity). For the UK, data relating to ethnic diversity is classed as “sensitive personal data” and requires self-identification. Therefore, for the placement statics relating to total or ethnic diversity (i.e.: include data from the UK) is not necessarily reflective of our placements but of those placements that have self-identified.. |

| PROXY SUMMARY |

HEIDRICK & STRUGGLES

20222023 Compensation Best Practices

Our compensation policies and practices include:

| |||

Independent HRCC. All of the members of the HRCC are independent.

| |||

Independent Compensation Consultant. The HRCC receives objective advice from an independent compensation consultant.

| |||

Emphasis on Variable Pay. At least 65% of total target executive compensation is delivered through variable pay tied to the achievement of certain Company and individual performance goals.

| |||

Annual Assessment. The HRCC conducts an annual assessment of compensation policies to ensure that they are aligned with the Company’s performance objectives, are competitive in the executive search and leadership consulting industry, and do not encourage undue risk.

| |||

Annual Payout Limits. The potential annual payout on annual incentive plan and PSUs is limited to 200% of target, as further described on pages

| |||

Long-Term Vesting. We encourage retention and long-term value creation by providing

| |||

No Excise Tax Gross-Ups. We do not provide excise tax gross-ups to the executive officers.

| |||

Double-Trigger Vesting. Our equity awards are subject to double-trigger vesting under our Change in Control Severance Policy.

| |||

Clawback

| |||

Stock Ownership Guidelines. The CEO is required to own five times their annual base salary in Company common stock, and all other NEOs are required to own two times their annual base salary. The CEO or other NEOs must retain ownership of Company shares in an amount equal to 50% of the net after-tax value of any newly-vested RSUs, performance shares and/or PSUs until the applicable multiple requirement is met, as further described on page

| |||

No Hedging or Pledging. We do not permit our executives to hedge or pledge Heidrick stock.

| |||

| PROXY SUMMARY |

PROXY STATEMENT 20232024

Key Elements of 20222023 Executive Compensation Program

|

|

20222023 Corporate Governance Highlights

We are committed to regularly monitoring and evaluating best practices and new developments in corporate governance against our current practices to promote long-term value and strengthen Board and management’s accountability to our stockholders, clients and other stakeholders. Highlights of our corporate governance framework include the following:

Number of director nominees:

|

|

Board and committee oversight of human capital management and other ESG programs and disclosures

| ✓

| |||

Percentage of independent director nominees:

|

|

Annual Board and committee self-assessments and director peer evaluations

| ✓

| |||

Directors attended

| ✓

|

Risk oversight by full Board and committees

| ✓

| |||

Annual election of directors

| ✓

|

Stock ownership guidelines for directors and executive officers

| ✓

| |||

Independent Chair of the Board

| ✓

|

Annual talent management and succession planning for the CEO and his direct reports

| ✓

| |||

Regular executive sessions for independent directors

| ✓

|

Demonstrated commitment to Board refreshment

| ✓

|

| PROXY SUMMARY |

HEIDRICK & STRUGGLES

20232024 Director Nominees Highlights

| PROXY SUMMARY |

PROXY STATEMENT 20232024

Proposals Submitted to

Vote at the Annual Meeting and Voting Recommendations

Item

|

Description

|

Recommendation

|

Page

|

Description

|

Recommendation

|

Page

| ||||||||||

| Election of Directors | ||||||||||||||||

1 |

Elizabeth L. Axelrod Mary E. G. Bear Lyle Logan T. Willem Mesdag |

Krishnan Rajagopalan Stacey Rauch Adam Warby |

For Each Nominee |

34 |

Elizabeth L. Axelrod Mary E. G. Bear John Berisford Lyle Logan |

Willem Mesdag Thomas L. Monahan III Stacey Rauch Adam Warby |

For Each Nominee |

27 | ||||||||

2 |

Advisory Vote to Approve Named Executive Officer Compensation |

For |

49 |

Advisory Vote to Approve Named Executive Officer Compensation |

For |

44 | ||||||||||

3 |

Advisory Vote on the Frequency of Future Executive Officer Compensation |

One Year |

87 |

Ratification of Independent Public Accounting Firm |

For |

91 | ||||||||||

4 |

Ratification of Independent Public Accounting Firm |

For |

93 |

Approval of the Fifth Amended and Restated Heidrick & Struggles 2012 GlobalShare Program |

For |

93 | ||||||||||

5 |

Approval of the Fourth Amended and Restated Heidrick & Struggles 2012 GlobalShare Program |

For |

95 | |||||||||||||

We will also conduct any other business as may properly come before the Annual Meeting and any adjournments or postponements of that meeting. The proxy holders will use their discretion to vote on other matters that may arise at the Annual Meeting.

| PROXY SUMMARY |

HEIDRICK & STRUGGLES

Who We Are

|

Heidrick & Struggles is a premier provider of global leadership advisory and on-demand talent solutions, providing integrated talent and human capital solutions to help our clients change the world, one leadership team at a time®.

In our role as trusted leadership advisors, we partner with our clients to help them fulfill their leadership and talent needs and develop future-ready leaders, teams and organizations. We do this by focusing on two primary areas: Talent Acquisition and Effectiveness of Leaders, Teams and Organizations. Our breadth of offerings helps us provide our clients with effective solutions to help them address their most important leadership priorities and challenges. We provide our services through our global network of approximately 460 consultants located in major cities around the world.

|

Executive Search

We partner with our clients – respected organizations across the globe – to help them build the best leadership teams in the world. Our consultants specialize in executive searches for Boards of Directors and the C-suite, including roles such as Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Chief Digital Officer and Chief Human Resources Officer, as well as functional officer roles in areas like Information Technology, Legal, Risk, Compliance and Government Affairs, Marketing, Sales and Strategy and Supply Chain and Operations. We also see growingcontinued demand for executive searches related to Diversity, EquityAI, Energy Transition, Healthcare & Life Sciences, Technology, and Inclusion, Sustainability, Energy, Industrial Goods & Technology, Health Technology and Consumer Products.Technology.

We have a highly respected brand with a global network of consultants and offices, and we are building larger and deeper accounts and helping our clients find forward-thinking, dynamic and diverse leaders for their organizations. We are market leaders in bringing the power of data to executive search and continually innovating, integrating new digital capabilities to provide world-class assessments and insights. This includes our Heidrick Leadership Framework, a uniform, data-driven framework, which brings together all of our data and research on leaders to help our clients understand what creates great leaders, going beyond things like experience and skills to also assess a leader’s impact on culture, and answer questions like “what makes an effective leader?” and “what are the most sought after attributes in leaders today?” Our relationship-based, data-driven approach allows us to complete searches with speed and precision, enabling us to help our clients identify the best leaders who can successfully lead their organizations to rally around their vision and deliver their business objectives.

On-Demand Talent

Through our leading On-Demand Talent services, we are bringing a transformational new way for our clients to quickly access flexible independent talent options to fulfil interim executive roles and high impact project needs. Alongside our Search offering, we can help clients quickly access talent, expertise and skills to solve for a variety of capability and capacity issues, such as: how to get talent faster; how to bring in a different type of talent; or how to get talent for a shorter, interim period. Companies today are using on-demand talent to augment their leadership capacity in a wide variety of ways, including leading operational transformation projects, analyzing new business opportunities, driving profitability improvement programs and implementing strategy. We are the biggest player in the US, growing in the UK, and in 2023 we acquired Atreus Group GmbH, a leading provider of interim management in Germany.

| WHO WE ARE |

PROXY STATEMENT 20232024

Heidrick Consulting

In our Heidrick Consulting business, we offer a uniquely broad set of leadership advisory solutions and work with clients through projectsprojectsdesigned to accelerate their strategies and larger journeys to help them become future-ready.the effectiveness of individual leaders, teams and organizations as a whole. We advise our clients on three key areas:

| ● | identifying, assessing and developing more effective, future-ready leaders; |

| ● | aligning leaders and teams around culture, purpose and strategy to drive organizational effectiveness; and |

| ● | aligning leaders around defining and implementing |

Working closely with our clients, we bring pragmatic solutions to create mindset shifts among leaders and teams, which helps to drive performance change and deliver tangible, meaningful and lasting impact. In 2023, we acquired businessfourzero, a London-headquartered consultancy specializing in developing and implementing purpose-driven change, enabling us to deepen our existing set of leadership advisory and industry-leading culture and organization solutions, and help our clients drive successful business transformations by linking purpose and strategy to leadership and culture.

By applying our deep understanding of the leadership attributes and behaviors of leaders that are most effective and in demand across many of the world’s premier companies, we guide our clients as they build future-ready leaders, teams and organizations. These premium services and offerings, which complement our Executive Search expertise, significantly contribute to our ability to deliver a full-service human capital consulting solution to our clients.

| WHO WE ARE |

HEIDRICK & STRUGGLES

Environmental

Stewardship, Social and Governance (“ESG”)ESG

|

At Heidrick, we aim to help our clients change the world, one leadership team at a time.®

In light of the importance placed on ESG issues by our clients, our shareholders, our employees, our communities and our broader stakeholder base, we evolve and monitor our ESG efforts through a global cross-functional team, including members of our Legal Department, Human Resources Department, Real Estate and Procurement teams and Sustainability practice, among others.

Our Nominating and Board Governance Committee of the Board is responsible for reviewing and making recommendations to the Board regarding the Company’s ESG programs and disclosures.

The most significant aspects of our ESG efforts and accomplishments, both internal and client-facing, are outlined below.

|

How We Champion ESG

At Heidrick, we are on the same ESG journey as our clients. In September 2022,light of the importance placed on ESG issues by our clients, our shareholders, our employees, our communities and our broader stakeholder base, we published our second ESG Report to outline our effortsevolve and disclose progress across ESG initiatives. Referencing both Global Reporting Initiative (“GRI”) and the Value Reporting Foundation Sustainability Accounting Standards Board (“SASB”) frameworks,monitor our ESG Report delves, in-depth, into Heidrick’s commitment to serving client needs,efforts through a global cross-functional team, including members of our Legal Department, Human Resources Department, Real Estate and Procurement teams and Sustainability practice, among others.

To help guide the Company’s ESG efforts, we determined our priority ESG issues. While we leveraged leading on diversityexternal frameworks and inclusion, supportingratings, we also engaged our key stakeholders, including our employees and communities where we workclients, to determine our critical focus areas. We believe the resulting priorities align with our core values and prioritizing environmental sustainability.will inform our focus and prioritization of our ESG program. Further information on our progress on these topics will be available in the upcoming 2023 ESG report.

For our complete ESG story, the Company’s latest ESG Report can be found here: https://investors.heidrick.com/static-files/518a94ad-8473-4268-8cd2-a6665ac4d731www.heidrick.com/-/media/heidrickcom/publications-and-reports/heidrick—struggles-2022-esg-report.pdf. The information contained in the Company’s ESG Report, or otherwise on or connected to the Company’s website, is not incorporated by reference into this proxy statement and should not be considered part of this or any other report filed with the SEC.

Environmental Sustainability: Creating the Foundation to Effectively Reduce Our Carbon Footprint

As one of the world’s largest executive recruiting and leadership advisory firms, we recognize the impact our offices and operations have on the planet, and we acknowledge our responsibility to reduce our environmental impact where possible. We care about our communities—local and global—and we are committed to pursuing environmental sustainability initiatives and creating transparency around our activities.

As part of our commitment to reducing our climate impact, we are actively working on setting emission reduction targets aligned with the SBTi, which we plan to submit in 2024. We are developing our targets and implementation

| ESG |

PROXY STATEMENT 20232024

plans in partnership with internal stakeholder groups, working across business lines, geographies and functions, to effectively reduce our carbon emissions, while maintaining our client focus.

To help us create and integrate ESG action plans across the business, we established an ESG governance framework by forming the ESG Working Group and ESG Steering Committee. These cross-functional groups help ensure that our commitment to sustainability remains an intrinsic part of our firm’s ethos by providing oversight of our ESG strategies and initiatives, setting direction and helping define priorities with the goal of creating alignment and building support for our ESG efforts throughout the business.

Lastly, we continued to partner with Indigo Ag for a multi-year program with a goal to offset a portion of our carbon emissions. Indigo Ag develops biological and digital technologies to improve farmer profitability, environmental sustainability, and consumer health. Their carbon offset credits support farmers who adopt regenerative, sustainable agricultural practices that reduce and sequester carbon dioxide while enriching their soil. Indigo Ag’s model is unique among carbon credit vendors—it offers technical and other support to growers and verifies carbon sequestered through a third-party audit for buyers. The number of verified carbon offset credits are expected to increase through the coming years, and we expect to offset approximately 25% of our total 2021 carbon emissions through verified carbon offset credits by the end of 2024.

Driving Inclusion Within Our Firm: Our Own Diversity, Equity and Inclusion (“DE&I”) Journey

We are committed to nurturing a culture that actively champions our DE&I efforts internally. We firmly believe in embedding DE&I principles throughout our organization and business relationships, including our hiring practices, business development and internal employee programming, learning and development. Our dedication to DE&I is steadfast, with the aim of fostering an environment where everyone feels valued, respected and empowered. By cultivating a culture that brings a spectrum of ideas and experiences to our work with clients around the world, we believe we create better solutions for our clients’ business challenges and win as one firm.

Employee Resource Groups (ERGs). Our ERGs, affinity groups for women, people of color, people with disabilities, Veterans and LGBTQ+ employees and their allies, give our employees a chance to share experiences, mentor, advocate and engage internally and externally with various networks. The Professionals of Color, Women’s Inclusion Network, Pride@Heidrick, Honoring Equality and Inclusion for Disability, Ethnic Diversity Engagement Network, and Veterans@Heidrick ERGs hosted global and regional panels and in-person events with leading experts and guest speakers throughout 2023, in addition to sponsoring days of recognition campaigns, internally and externally. As of February 2024, approximately 30% of Heidrick & Struggles employees were active members of least one ERG.

Learning and Development. We are committed to investing in learning and professional development opportunities for various employee populations and position levels and have implemented and enhanced a series of programs that focus on mitigating bias, training, coaching, community building and sponsorship for our next generation of diverse business professionals and senior leaders. These programs help us to recruit, engage and develop diverse talent in differentiated and comprehensive ways as we support them in their career advancement and accelerate their readiness for expanded roles and opportunities. In 2023, our Learning & Development team delivered over 10,500 hours of facilitated training to our colleagues globally and employees completed over 5,000 self-paced courses.

People: Winning Teams Come from an Extraordinary Culture

As leaders in helping clients attract, develop and retain the highest-performing talent, we are constantly learning and promoting leadership and management best practices, which we also seek to incorporate into our own firm. We view our culture as a strategic differentiator, one where our colleagues can engage deeply in their work, pursue their passions and bring their authentic selves to the workplace. We believe this type of culture creates an environment that is most conducive for developing dynamic, productive teams and individuals.

| 12 | ESG |

HEIDRICK & STRUGGLES

We are committed to supporting our employees both professionally and personally as they continue to navigate a rapidly changing world on multiple fronts. One of the objectives of our benefits program is to help promote employee wellness.

We believe an engaged workforce is crucial to our success and our culture. To that end, we are keenly focused on creating an environment where employees are acknowledged, valued and supported. Employee engagement is a key element to attracting, developing, promoting and retaining the highest-performing talent and building a more diverse, equitable and inclusive workplace.

We are committed to the professional development of our employees and promoting a continuous learning culture within our firm. We have a comprehensive, global talent management framework across business lines that we use to support and grow our people and deliver on the firm’s strategic objectives.

Serving Clients: Finding Leadership Solutions for

Sustainable, Diverse and Inclusive Businesses

In 2022,2023, we completed 259300+ ESG related executive search and consulting assignments, partnering with our clients, candidates, employees and communities with an aim to make the world a better place. From 2018 through 2022, we completed 945 such assignments – representing oneOne of the fastest growing segments of our business. Ourbusiness, our ESG and Sustainability OfficePractice focuses on sustainability officer roles, board placements focused on sustainability expertise, sustainable product or service businesses, businesses working to embed sustainability into their strategy, and sustainable assets managers, private equity funds, not-for-profit and philanthropic organizations, development banks and others.

Our global Diversity, Equity & Inclusion (“DE&I”)&I practice brings together Executive Search and Heidrick Consulting to help clients build diverse and inclusive leadership teams, organizations, and cultures. Since launching in 2017, theThe DE&I practice has built a comprehensive, integrated suite of services and solutions that can be adapted and customized to meet our clients’ DE&I needs. With a complementary lens on talent recruitment, leadership development, and building inclusive cultures, the practice enables us to help our clients achieve their DE&I goals, no matter where they are in their journeys. As a recognized industry authority on leadership and human capital, we take a business-focused, data-driven, and leader-led approach where DE&I not only fosters positive change, but also drives performance and growth. Our DE&I offerings provide strategic advisory services through data-driven insights designed to accelerate performance. At the Board of Directors level, 63%61% of our U.S. placements in 20222023 were diverse and 60%58% globally exceeding8, an outcome to our Board Diversity Pledge. 47%Pledge, a global commitment that a minimum of our total U.S. placements in 2022 were diverse.5

Driving Change Within Our Firm: Our Own DE&I Journey

We believe that diversity, equity, and inclusion are key elementshalf of Heidrick & Struggles’ ability to mobilize, execute and transform with agility. Our commitment to DE&I is a key business imperative that is deeply rooted in our organizational values. We are dedicated to building diverse leaders and teams and creating an inclusive culture and workplace, where all voices are engaged and heard; all individuals feel safe, valued and accepted; and all feel empowered to thrive, make meaningful contributions and achieve equitable success. DE&I are critical strategic pillars at our firm that continue to sustain our multi-layered cultural journey as highlighted below.

Leadership. In February 2022, we appointed Cecilia Nelson-Hurt as our firm’s first Chief Diversity, Equity and Inclusion Officer, as we looked to accelerate our firm’s transformation and growth journey, globally. Ms. Nelson-Hurt is charged with leading the Company’s DE&I strategy and delivering long-term, sustainable programs and initiatives that build on our values and commitment to create an unrivaled culture within the executive talent and leadership advisory industry.

|

HEIDRICK & STRUGGLES

Employee Resource Groups (ERGs). Our ERGs, affinity groups for women, people of color, people with disabilities and LGBTQ+ employees, give our employees a chance to share experiences, mentor, advocate and engage internally and externally with various networks. The Professionals of Color, Women’s Inclusion Network, Pride@Heidrick, Honoring Equality and Inclusion for Disability, and Ethnic Diversity Engagement Network ERGs hosted global and regional panels and in-person events with leading experts and guest speakers throughout 2022, in addition to sponsoring days of recognition campaigns, internally and externally. As of March 2023, approximately 30% of Heidrick & Struggles employees were active members of an ERG.

Professional Development. We are committed to investing in professional development opportunities for various employee populations and position levels and have implemented and enhanced a series of programs that focus on training, coaching, community building and sponsorship for our next generation of diverse business professionals and senior leaders. These programs helpcumulative initial board candidates presented by us to engage and develop diverse talent in differentiated and comprehensive ways as we support them in their career advancement and accelerate their readiness for expanded roles and opportunities.

People: Winning Teams Come fromour clients globally on an Extraordinary Culture

As leaders in helping clients attract, develop and retain great talent, we are constantly learning and promoting management best practices, which we also seek to incorporate into our own firm. We therefore strive to create an open, inclusive and committed culture where our employees find fulfillment through their jobs and can deliver their best because they feel safe bringing their whole selves to work. This work begins by implementing policies and programs that support our employees’ success by creating a welcoming environment that is free from harassment, and provides growth opportunities, as well as health and wellness benefits.

In June 2022, we launched a new Voice of Employee pulse survey platform that offers employees the opportunity to regularly and confidentially share feedback on their experience at Heidrick and provides our leaders with additional data on how they can best lead their teams. We use the tool to evaluate three areas of the employee experience: Engagement, Diversity & Inclusion, and Health & Wellbeing. Data from the surveys is shared anonymously with key leaders across geographies, practices and businesses. Additionally, the platform allows us to track our progress and better understand how we are doing in our efforts, while using others in the industry as benchmarks.

We are committed to the professional development of our employees and promoting a continuous learning culture within our firm. Our learning and development programs have been created with the goal of building leadership, business development, account management, client service, and change leadership skills among our employees. In addition to building personal and professional capabilities, these programs set a standard for the behaviors we believeannual basis will help us realize our business goals and strategies. In 2022, our Learning & Development team delivered over 17,900 hours of aggregate live training to our colleagues globally. Our programming was deployed in both virtual and in-person formats. Our learning catalog outlines dozens of live, virtual programs and thousands of eLearning courses designed to help build and enhance employee leadership, business acumen and business development skills. These programs are continually updated to reflect best practices and feedback received from employees.

In 2022, we continued to focus on helping to ensure the health and safety of our employees. We expanded our flexible working philosophy to provide additional guidance to managers and employees on our evolving approach to a hybrid work environment. We are committed to ensuring our people can safely follow country- and state-level health guidance, while also having the opportunity to grow professionally and personally through in-person collaboration and development.

PROXY STATEMENT 2023

As we strive to build an unrivaled culture for high-performing talent at Heidrick, our firm’s leaders continue to play a central role in this work, and we are further investing in our firm’s own leadership capabilities. This includes the launch of a new transformational leadership development program, which is designed to help our leaders maximize their impact in the rapidly evolving workplace and build upon existing leadership skills and experiences, focusing on resilience, vulnerability, trust, and living our firm’s values. In 2022, we launched six cohorts, and 119 senior level employees went through the program. The program is a multi-year investment in our leadership that we plan to cascade across multiple cohort groups throughout the organization.be diverse.

Community: Lending a Hand to Our Neighbors

We strongly believe that the benefits of our success and scale should enrich all of our stakeholders, especially the communities in whichwhere we operate.live and work. We are committedknow first-hand from our client work the positive effects that strong leaders can bring to being responsible globalboth organizations and corporate citizens by positively contributingcommunities and encourage employees to the communities in which we work and live. In 2022:

|

|

Environmental Sustainability: Shrinking Our Carbon Footprint

As one of the world’s largest executive recruiting and leadership advisory firms, we recognize the impact our offices and operations have on the planet, and we acknowledge our responsibility to reduce our environmental impact where possible and pursue environmental sustainability initiatives. We care about our communities – local and global – and we are committed to reducingas well. On our impact and creating transparency around our activities.

We have partnered with Indigo Ag for a multi-year program to offset a significant portionfifth Global Day of our carbon emissions. Indigo Ag develops biological and digital technologies to improve farmer profitability, environmental sustainability, and consumer health. Their carbon offset credits support farmers who adopt regenerative, sustainable agricultural practices that reduce and sequester carbon dioxide while enriching their soil. Indigo Ag’s model is unique among carbon credit vendors—it offers technical and other support to growers and verifies carbon sequestered through a third-party audit for buyers. Our purchases of verified carbon offset credits are expected to increase through the coming years and to offset approximately 58% of our 2021 carbon emissionsService, over 780 employees in 2023.

In 2019 we began studying our carbon footprint which shrank considerably in 2020 and 2021 as we transitioned to serving clients virtually due to the pandemic. We measure our Scope 1, Scope 2 and Scope 3 carbon emissions. In 2020, as most of our employees began working remotely under our newly formalized hybrid workplace philosophy, we began to reassess our total real estate footprint. Since 2020, we have successfully reduced our square footage from over 441,000 square feet to roughly 349,000 at the end of 2022, a reduction of 21% of our real estate footprint. In addition to office shrinkages, the way our teams work has also given us flexibility to recycle furniture throughout our various offices.

Currently, Heidrick serves clients through a network of 54 offices in 29 countries. We lease space in over 20 green buildings across the globe, including many LEED buildings in the U.S. We pursue environmental sustainability initiatives when building and maintaining our offices globally. When assessing our lease renewals and moves, we take into consideration the type of green or LEED certified building and how it impacts our carbon footprint. When building or renovating our offices, we prioritize working with vendors and suppliers who produce eco-friendly products, and we look to add natural greenery into our offices around the world.world donated over 2,960 hours to 45 non-profit organizations. We also support our employees who bring attention to philanthropic causes and organizations that they engage with independently.

| 8 | Global updates comprise females globally plus ethnic diversity for males in the United States, Canada, Australia and the UK (the countries where we currently track ethnicity). For the UK, data relating to ethnic diversity is classed as “sensitive personal data” and requires self-identification. Therefore, for the placement statics relating to total or ethnic diversity (i.e.: include data from the UK) is not necessarily reflective of our placements but of those placements that have self-identified. |

| ESG | 13 |

HEIDRICK & STRUGGLESPROXY STATEMENT 2024

Governance

| 14 | ||

PROXY STATEMENT 2023HEIDRICK & STRUGGLES

Governance

Heidrick understands that corporate governance is not static, and as a result, we regularly monitor and evaluate best practices and new developments in corporate governance against our current practices. The value proposition of good governance extends beyond our own internal practices, as we serve as a trusted advisor to boards and C-suites on myriad issues. Heidrick offers its clients an integrated suite of services and advisory expertise at the CEO and board level, ranging from the acquisition of talent to longer-term Succession Planning, Board Dynamics and Culture Shaping.

Heidrick has built its reputation over the course of several decades on its core value of always acting with integrity. Our commitment to the highest levels of integrity and transparency in our business allows our investors to better assess risk and the value of our Company. Internally, Heidrick’s governance requires oversight at all levels. Heidrick invests in its people who are responsible for keeping careful watch over the Company’s assets – whether they are monetary in value, confidential data assets or other assets entrusted to the Company.

Heidrick is committed to translating our values and strategy into measurable results in order to improve our own performance on ESG issuestopics that are material to our stockholders, the clients we serve, the candidates and participants with whom we interact and engage, and others with whom we work every day.

Board Structure

The current members of the Board of Directors are: Elizabeth L. Axelrod, Mary E. G. Bear, John Berisford, Lyle Logan, T. Willem Mesdag, Krishnan Rajagopalan,Thomas L. Monahan III, Stacey Rauch and Adam Warby.

The Board met four timesheld five meetings during 2022.2023. Each current member of our Board of Directors (individually, “director”, and together, “directors”) attended 100% of allat least 75% of the meetingsaggregate number of the Board and committee(s)committee meetings that occurred in 2023 during his or her tenure on which they served.the Board. Pursuant to our Director Attendance at Annual Meetings Policy contained in our Corporate Governance Guidelines, all directors are expected to make every effort to attend the Company’s annual meeting of stockholders, and all of them attended in 2022.2023 (with the exception of John Berisford, who was appointed to the Board effective June 20, 2023 and Mr. Monahan, who was appointed as CEO and appointed to the Board effective March 4, 2024). The Company believes that annual meetings provide an opportunity for stockholders to communicate with directors.

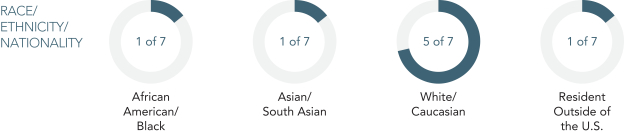

Board Diversity

We believe that having a diverse Board of Directors enhances our Company’s performance, due to the nature of our business, our own organizational values and commitments, and the power of diverse perspectives to improve board composition and functioning. We are in the human capital business, focused on helping our clients build high-performing leadership teams and cultures, and diversity in those teams and cultures is an important accelerator for their success. Within our own Company, our commitment to promoting diversity, equity and inclusion is deeply rooted in our organizational values and is fundamental to how we operate; a diverse Board visibly exemplifies that commitment for all our employees and our clients. Further, we believe that considering diverse individuals allows us to recruit from a broader pool of talented candidates to join our Board, and that a board comprised of directors with diverse backgrounds, experiences and perspectives improves the dialogue and decision-making in the boardroom, helps advance our long-term strategy and contributes to overall board effectiveness. Consequently, we consider the diversity of candidates and of the Board overall with respect to skills, experience and viewpoints, as well as self-identified characteristics including gender, age, ethnicity, national origin and sexual orientation, and we include diverse candidates in all searches for new Board members.

| GOVERNANCE | 15 |

HEIDRICK & STRUGGLESPROXY STATEMENT 2024

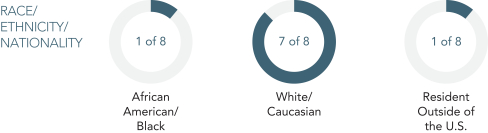

The below matrix outlines the gender and demographic diversity of the current members of our Board, in accordance with Nasdaq’s board diversity disclosure rules.

Board Diversity Matrix (As of April 14, 2023)

|

|

Male

|

|

|

Female

|

| ||||||||||

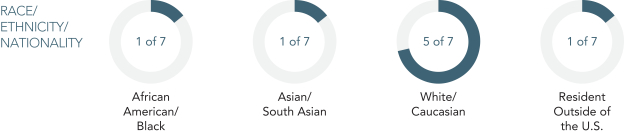

Board Diversity Matrix (As of April 12, 2024)

|

|

Male

|

|

|

Female

|

| ||||||||||

Total Number of Directors: 7

| ||||||||||||||||

Total Number of Directors: 8

| ||||||||||||||||

Total Number of Directors: 8

| ||||||||||||||||

Total Number of Directors: 8

| ||||||||||||||||

Total Number of Directors: 8

| ||||||||||||||||

| Part I: Gender Identity | ||||||||||||||||

| Part I: Gender Identity | ||||||||||||||||

| Part I: Gender Identity | ||||||||||||||||

| Part I: Gender Identity | ||||||||||||||||

Directors

|

| 3

|

|

| 4

|

| ||||||||||

Directors

| ||||||||||||||||

Directors

| ||||||||||||||||

Directors

|

| 5

|

|

| 3

|

| ||||||||||

| Part II: Demographic Background | ||||||||||||||||

| Part II: Demographic Background | ||||||||||||||||

| Part II: Demographic Background | ||||||||||||||||

| Part II: Demographic Background | ||||||||||||||||

| African American or Black | 1 | |||||||||||||||

| African American or Black | ||||||||||||||||

| African American or Black | ||||||||||||||||

| African American or Black | 0 | 1 | ||||||||||||||

| Asian | 1 | 0 | 0 | |||||||||||||

White

| 3 | 2 | 4 | 3 | ||||||||||||

Board Leadership

The Board does not have a fixed policy regarding the separation of the offices of Chair of the Board (the “Chair”) and CEO and believes that it should maintain the flexibility to select the Chair and its Board leadership structure, from time to time, based on the criteria that it deems to be in the best interests of the Company and our stockholders. The Board believes that it is in the best interests of the Company for the Board periodically to evaluate and determine whether the roles of Chair and CEO should be separated or combined, based on the needs of the Board and the Company at such time. In the event that circumstances facing the Company change, a different leadership structure may be in the best interests of the Company and our stockholders. For this reason, our Board evaluates issues that may be relevant to our leadership structure as part of our annual Board evaluation process.

Mr. Adam Warby has served as our independent Chair since June 6, 2019. The Chair’s duties include coordinating the activities of the independent directors, coordinating the agenda for and moderating sessions of the Board’s independent directors, and facilitating communications among the other members of the Board. This structure also allows the CEO to focus his energies on the management of the Company. We believe this structure provides strong independent leadership and oversight for our Company and our Board, while positioning our CEO as the leader of the Company for our investors, counterparties, employees and other stakeholders.

Every director on our Board, other than our CEO, is independent. We believe that the number of independent, experienced directors that make up our Board benefits our Company and our stockholders.

PROXY STATEMENT 2023

Board and Committee Self-Assessments

Our Board conducts an annual self-assessment led by the Nominating and Governance Committee (the “NGC”) (as defined below). Each director receives a written questionnaire seeking his or her responses to questions on a wide range of subjects relating to the structure, functioning and performance of the Board and its committees. The NGC reviews the form of questionnaire each year and revises it as the NGC considers appropriate in light of evolving practices among other companies as well as suggestions made by directors in the self-assessment process. In addition, the Chair of the Board meets individually with each director to solicit theirhis or her views on the Board, its committees and

| 16 | GOVERNANCE |

HEIDRICK & STRUGGLES

the performance of individual directors. The results of this process are discussed by the Board and its committees, and changes are made as and when appropriate to respond to the directors’ feedback. For example, in recent years, in response to observations that were made during the self-assessment process, the Board has devoted more time and focus to strategy development and implementation and has undertaken an ongoing series of in-depth reviews with management of various parts of our business as a regular feature of Board meetings.

Director Independence

We determine the independence of all non-employee directors in accordance with the independence requirements of our Corporate Governance Guidelines, our Director Independence Standards, our Related Party Transaction Policy and the rules of the Nasdaq Stock Market (“Nasdaq Rules”). Our Corporate Governance Guidelines, our Director Independence Standards and our Related Party Transaction Policy can be found at

https://investors.heidrick.com/corporate-governance.

Pursuant to the policies listed above, we affirmatively assess whether each director has a relationship that would interfere with the exercise of independent judgment pursuant to these policies and corporate governance best practices.

In addition to the NGC’s review, the Board conducts an annual review of director independence, during which the Board also considers transactions, relationships and arrangements between each director or an immediate family member of the director and each of the Company and our executive officers.

The Board has determined that each of the following non-employee directors who served during the last completed fiscal year qualifies as “independent” in accordance with the above listed guidelines, standards and rules: Elizabeth L. Axelrod, Laszlo Bock (who served until the 2022 Annual Meeting of Stockholders), Mary E. G. Bear, John Berisford, Lyle Logan, T. Willem Mesdag, Stacey Rauch, and Adam Warby. As KrishnanMr. Rajagopalan iswas employed by Heidrick as our President and CEO he does not qualifyduring the last completed fiscal year, and Mr. Monahan is currently employed by Heidrick as our CEO, neither qualifies as independent.

Board Committees

The Board has three standing committees: the Audit & Finance Committee (“AFC”), the Human Resources and Compensation Committee (“HRCC”) and the Nominating and Board Governance Committee (“NGC”). We have reviewed and determined that each of the members of the standing committees is independent under the provisions of the applicable committee’s charter, our Corporate Governance Guidelines, our Director Independence Standards, our Related Party Transaction Policy and Nasdaq Rules. The Board has approved a written charter for each standing committee, which we reviewthe Board reviews annually and reviserevises as appropriate. The charters define each committees’committee’s roles and responsibilities. The charters are available on our website at:

https://investors.heidrick.com/corporate-governance.

| GOVERNANCE | 17 |

HEIDRICK & STRUGGLESPROXY STATEMENT 2024

The table below outlines the current membership and the frequency of meetings for each Board committee in 2022.committee.

Name

|

AFC

|

HRCC

|

NGC

| ||||||||||||

Elizabeth L. Axelrod

|

Chair*

|

Chair**

| |||||||||||||

Laszlo Bock (until May 26, 2022)

|

Chair*

| ||||||||||||||

Mary E. G. Bear

|

✔

| ||||||||||||||

Lyle Logan

|

✔

|

✔

| |||||||||||||

T. Willem Mesdag

|

Chair

|

✔

| |||||||||||||

Krishnan Rajagopalan (CEO)

| |||||||||||||||

Stacey Rauch

|

✔

|

Chair**

| |||||||||||||

Adam Warby (Chairman)

| Ex Officio

|

Ex Officio

| Ex Officio

| ||||||||||||

Number of Meetings in 2022

|

6

|

4

|

4

| ||||||||||||

* Ms. Axelrod became Chair of the HRCC effective May 26, 2022 and was a member of the HRCC until that date. Mr. Bock was Chair of the HRCC until May 26, 2022, when his Board service ended following his decision not to stand for re-election at the 2022 annual stockholders meeting.

** Ms. Rauch became Chair of the NGC effective May 26, 2022 and was a member of the NGC until that date.

Ms. Axelrod was Chair of the NGC until May 26, 2022, and remained a member of the NGC after that date.

PROXY STATEMENT 2023

Name

| AFC

| HRCC

| NGC

| |||

Elizabeth L. Axelrod

| Chair

| ✔

| ||||

Mary E. G. Bear

| ✔

| |||||

John Berisford

| ✔

| ✔

| ||||

Lyle Logan

| ✔ | ✔ | ||||

Willem Mesdag

| Chair

| ✔ | ||||

Thomas L. Monahan III (CEO)

| ||||||

Stacey Rauch

| ✔

| Chair

| ||||

Adam Warby (Chair)

| Ex Officio

| Ex Officio

| Ex Officio

| |||

| Number of Meetings in 2023 | 6 | 4 | 5 | |||

The Chair is an ex officio member of the respective committees but is excluded from discussions regarding Chair compensation. Additionally, the CEO is permitted to attend committee meetings only at the invitation of the respective committee. Accordingly, the CEO is not permitted to attend committee meetings when the independent directors meet in executive session, such as when independent directors conduct performance evaluations or discuss the compensation of the CEO, or any other portion of any committee meeting that the independent directors deem appropriate to conduct outside of the CEO’s presence for any reason.

| 18 | GOVERNANCE |

HEIDRICK & STRUGGLES

| Audit & Finance Committee (“AFC”)

The AFC serves as an independent committee to assist in Board oversight of: |

AFC

| ||

The integrity of the Company’s financial statements

|

✔

| |

The Company’s compliance with legal and regulatory requirements that may have a material impact on financial statements, financial condition or results of operations

|

✔

| |

The independent registered public accounting firm’s appointment, retention, qualifications and independence

|

✔

| |

The Company’s risk, compliance and internal audit functions

|

✔

| |

The review and recommendation to the Board concerning the payment of dividends

|

✔

| |

The review of all related party transactions reported to the AFC by the NGC for appropriate financial statement disclosure

|

✔

|

In addition, the AFC consults with the NGC on the adequacy of the Code of Ethics, reviews the Company’s procedures for detecting violations of and ensuring compliance with the Code of Ethics and reviews violations and waivers of the Code of Ethics. Each member of the AFC is able to read and understand fundamental financial statements (as required under Nasdaq Rules) and meets the heightened standards of independence for audit committee members pursuant to the rules and regulations of the SEC (the “SEC Rules”). Messrs. Berisford, Mesdag and Logan each qualify as an “audit committee financial expert” within the meaning of the SEC Rules. All of the members of the AFC (Messrs. Berisford, Mesdag and Logan and Ms. Rauch, as well as Mr. Warby, who is a member of the AFC ex officio based on his status as Chair of the Board) are presumed to be financially sophisticated for purposes of the Nasdaq Rules.

| GOVERNANCE | 19 |

HEIDRICK & STRUGGLESPROXY STATEMENT 2024

| Nominating and Board Governance Committee (“NGC”)

The NGC serves as an independent committee to assist the Board in determining: |

NGC

| ||

The criteria for directors and the recommendation of nominees for election to the Board

| ✔ | |

Committee membership recommendations

| ✔ | |

Recommendations regarding the independence of director nominees and committee members under applicable standards

| ✔ | |

The Company’s corporate governance policies, including the Corporate Governance Guidelines and Code of Ethics

| ✔ | |

The form and amount of director compensation

| ✔ | |

Oversight of other board memberships/limits on directorships

| ✔ | |

CEO succession

| ✔ | |

The Company’s ESG programs and disclosures

| ✔

| |

In addition, the NGC coordinates and assists the directors, the Board and its committees with their annual evaluations. The NGC also reviews and approves related party transactions in consultation with the AFC. All of the members of the NGC are independent within the meaning of the Nasdaq Rules and the Company’s Corporate Governance Guidelines, Director Independence Standards, and Related Party Transaction Policy, which can be found at https://investors.heidrick.com/corporate-governance.

| 20 | ||

| GOVERNANCE |

PROXY STATEMENT 2023HEIDRICK & STRUGGLES

| Human Resources and Compensation Committee (“HRCC”)

The HRCC serves as an independent committee to assist in Board oversight of: |

HRCC

| ||

Administering and recommending all elements of compensation for the CEO; administering and approving all elements of compensation for the other executive officers

| ✔ | |

Adopting, administering and approving cash incentive compensation plans and specific awards under the Company’s equity-based plans

| ✔ | |

Reviewing and approving terms of employment, severance or other compensation-related agreements for any executive officer

| ✔ | |

Developing and implementing the Company’s compensation clawback

| ✔ | |

Approving the peer group used for the executive compensation benchmarking purposes

| ✔ | |

Providing oversight and risk assessments in connection with Company-wide compensation programs

| ✔ | |

Providing guidance on strategically critical human capital matters

| ✔ | |

Reviewing talent management and succession planning for the CEO’s direct reports

| ✔ | |

Reviewing annually, in consultation with senior management, the Company’s diversity and inclusion practices, key metrics, and talent pipelines

| ✔ | |

Reviewing and providing advice to management on the Company’s broad-based employee compensation programs

| ✔ | |

Each member of the HRCC meets the qualifications for compensation committee members pursuant to the Nasdaq Rules and is a “non-employee director” within the meaning of SEC Rule 16b-3. The HRCC may delegate authority to subcommittees when appropriate.

| GOVERNANCE | 21 |

HEIDRICK & STRUGGLESPROXY STATEMENT 2024

Board Oversight of Corporate Strategy

Our Board takes an active role with management to formulate and review our long-term corporate strategy, including major business and organizational initiatives, growth opportunities and capital allocation priorities. On a quarterly basis the Board is provided a strategic update and management and the Board conduct an in-depth review of different aspects of the corporate strategy. Additionally, on an annual basis the Board and management conduct an in-depth, comprehensive review of the progress made against our strategic goals for the short and long-term.

The Board of Directors’ Role in Risk Oversight

Management is responsible for the day-to-day management and assessment of risk at the Company, including communication of the most material risks to the Board and its committees. The Board promotes an appropriate culture of risk management within Heidrick, sets the “tone at the top,” oversees the aggregate risk profile and monitors how Heidrick addresses specific risks. In carrying out this responsibility, the Board and its committees provide oversight over the risk management practices implemented by management.

The Board has delegated oversight of some risks to committees of the Board. However, even when the oversight of a specific area of risk has been delegated to a committee, the full Board maintains oversight over such risks through the receipt of reports from the respective committee chair to the full Board at each regularly scheduled full Board meeting. In addition, if a particular risk is material or where otherwise appropriate, the full Board may assume oversight over a particular risk, even if the risk was initially overseen by a committee. The Board does not view risk in isolation, but instead considers risk in conjunction with its oversight of Heidrick’s strategy and operations. The Board considers multiple time horizons, extending over several years, in its assessment of risks.

In its risk oversight role, the Board assesses whether the risk management processes and policies designed and implemented by management are adequate and functioning as designed. The Board performs its risk oversight function primarily through its committees as well as through reports the Board receives directly from management. The Board, its committees, and management coordinate risk oversight and management responsibilities in a manner that we believe serves the long-term interests of our company and our shareholders.

PROXY STATEMENT 2023

Board of Directors

● The Board exercises its oversight responsibility for risk both directly and through its standing committees.

● Throughout the year, the Board and each committee spend a portion of their time reviewing and discussing specific risk topics.

● On an annual basis, members of senior management report on our top enterprise risks, and the steps management has taken or will take to mitigate those risks. The AFC assists the Board in these responsibilities.

● Our Chief Legal Officer (who functions as the Company’s chief compliance officer) updates the Board and relevant committees regularly on legal and regulatory matters.

● Written reports also are provided to and discussed by the Board regularly regarding recent business, strategic, competitive, operational, human capital, privacy and cybersecurity, legal and compliance and other developments impacting the Company.

| ||||||||

| 22 | GOVERNANCE |

HEIDRICK & STRUGGLES

Human Resources and Compensation Committee

Oversees risks related to employees and compensation, including:

● our compensation policies and practices for employees

● our incentive compensation plans

● senior management succession

● attraction and retention of talent

● diversity, equity & inclusion | Nominating and Board Governance Committee

Oversees risks related to our overall corporate governance, including:

● Board effectiveness

● Board and committee composition

● Board structure

● Board succession

● CEO succession

● environmental, social and governance (ESG) factors

| Audit & Finance Committee

Oversees risks related to:

● financial statements, financial reporting and internal controls

● legal and compliance risks

● cybersecurity

● Code of Ethics compliance

● the global economic environment

● the competitive landscape |

HEIDRICK & STRUGGLES

Enterprise Risk

Management undertakes a regular review of a broad set of enterprise risks across the Company’s business and operations to identify, assess, prioritize and manage potential issues. Specific emphasis is placed on identifying those risks that could have the highest impact to the Company and its operations, and the highest likelihood of risk occurrence. Management’s risk assessment also takes into account input from the internal audit function which reports regularly to the AFC. The Board receives ongoing updates from risk professionals on trends in risk management and in new risks facing the business. The directors have direct access to risk professionals. The AFC assists the Board in its responsibility to oversee our enterprise-level risk profile, monitor the processes and systems of enterprise risk management, and oversee management’s efforts to mitigate enterprise-wide risks facing the Company.

As part of management’s risk identification and mitigation efforts, along with the annual plans for managing and, where appropriate, mitigating significant Company risks that the Board receives, management has created and discussed with the Board an Incident Response Plan (“IRP”IRP”) framework which includes IRPs relating to a number of specific topics, including business continuity; data security; litigation and government investigations; and misconduct, harassment and sexual harassment. The IRPs articulate the reporting obligations for management to inform the Board of significant incidents and, where appropriate and possible, describe and delineate the Board and/or committee obligations with respect to such incidents, including identifying incidents requiring immediate Board oversight and input.

Compensation Risk

The Company completes an inventory of its executive and non-executive compensation programs globally, with particular emphasis on incentive compensation plans and programs. Based on this inventory, the Company evaluates the primary components of its compensation plans and practices to identify whether those components, either alone or in combination, properly balance compensation opportunities and risk.

Moreover, the HRCC at least annually conducts a risk assessment to determine whether the Company’s incentive compensation plans encourage excessive or inappropriate risk taking, and whether the risks arising from the Company’s compensation plans, policies and programs for its employees are reasonably likely to have a material adverse effect on the Company. Based on the Company’s assessments, the Company has determined that none of its compensation policies and practices are reasonably likely to have a material adverse effect on the Company. The Company believes that its overall cash versus equity pay mix, variable versus fixed pay elements, balance of shorter-termshorter-

| GOVERNANCE | 23 |

PROXY STATEMENT 2024

term versus longer-term performance-focused and revenue-focused (versus profit-focused) performance measures, stock ownership guidelines and use of compensation “claw-backs”“clawbacks” work together to provide its employees and executives with incentives to deliver outstanding performance to build long-term stockholder value, while taking only necessary and prudent risks.

Code of Ethics

The Board has adopted a Code of Ethics (the “Code”) that applies to all of the Company’s employees, officers and directors, as well as independent contractors working on behalf of the Company. Through our Code, we establish clear ethical and professional guidelines, and work though several mechanisms to hold the Company collectively to the highest professional ethical standards.